Car Depreciation Limit 2024 For Business Use – Currently, the government provides a 10% depreciation on imported vehicles 10% up to two years, 20% up to three years, 30% up to four years and 35% for four to five years depending on the . Aesthetics are fine, and choosing a sports car might be a fun statement of ambition from your business. However, will it be of much use at 2:30 p.m. on a Wednesday Extras can bring practical .

Car Depreciation Limit 2024 For Business Use

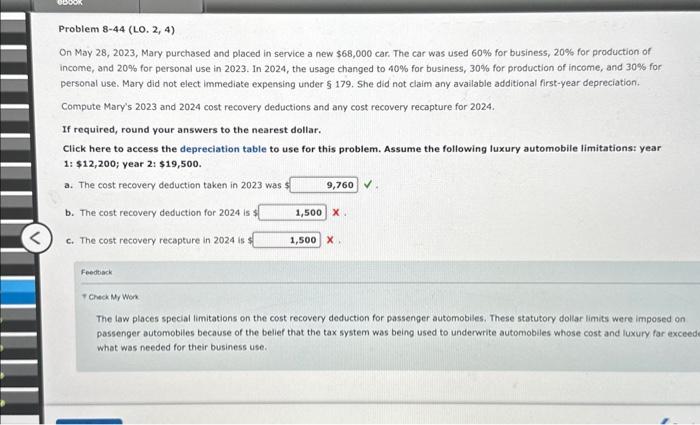

Source : www.jeep.comSolved On May 28,2023 , Mary purchased and placed in service

Source : www.chegg.comSection 179 Deduction – Section179.Org

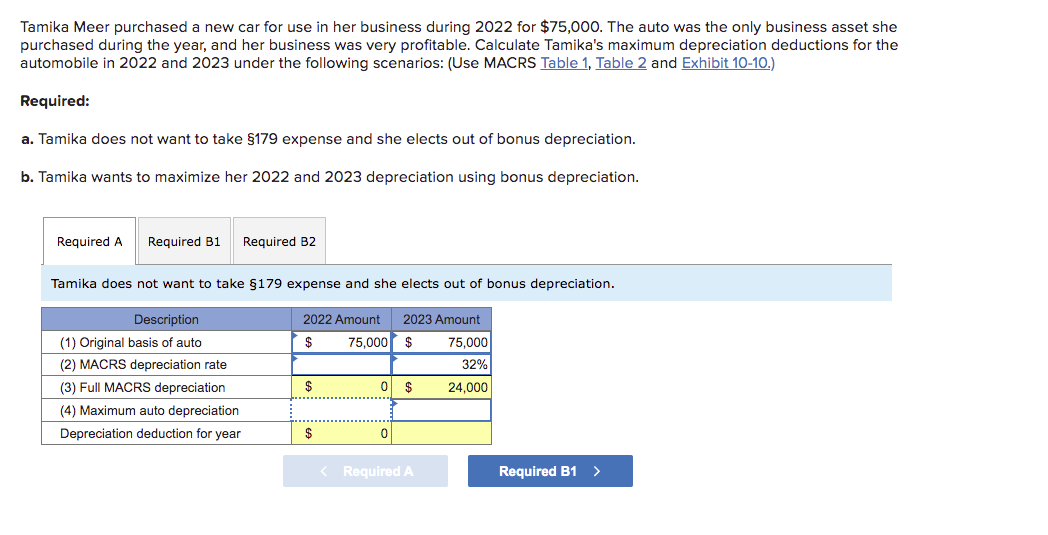

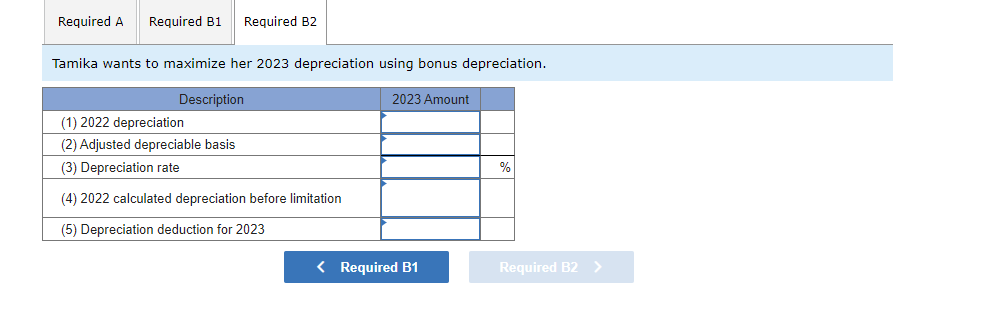

Source : www.section179.orgSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.comSection 179 & More Business Vehicle Tax Deductions | Jeep

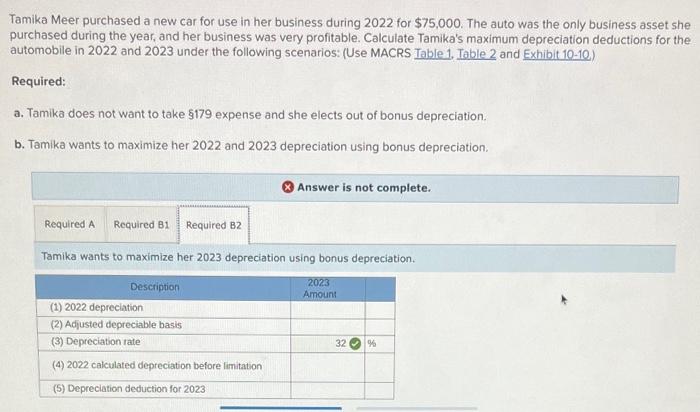

Source : www.jeep.comSolved Tamika Meer purchased a new car for use in her | Chegg.com

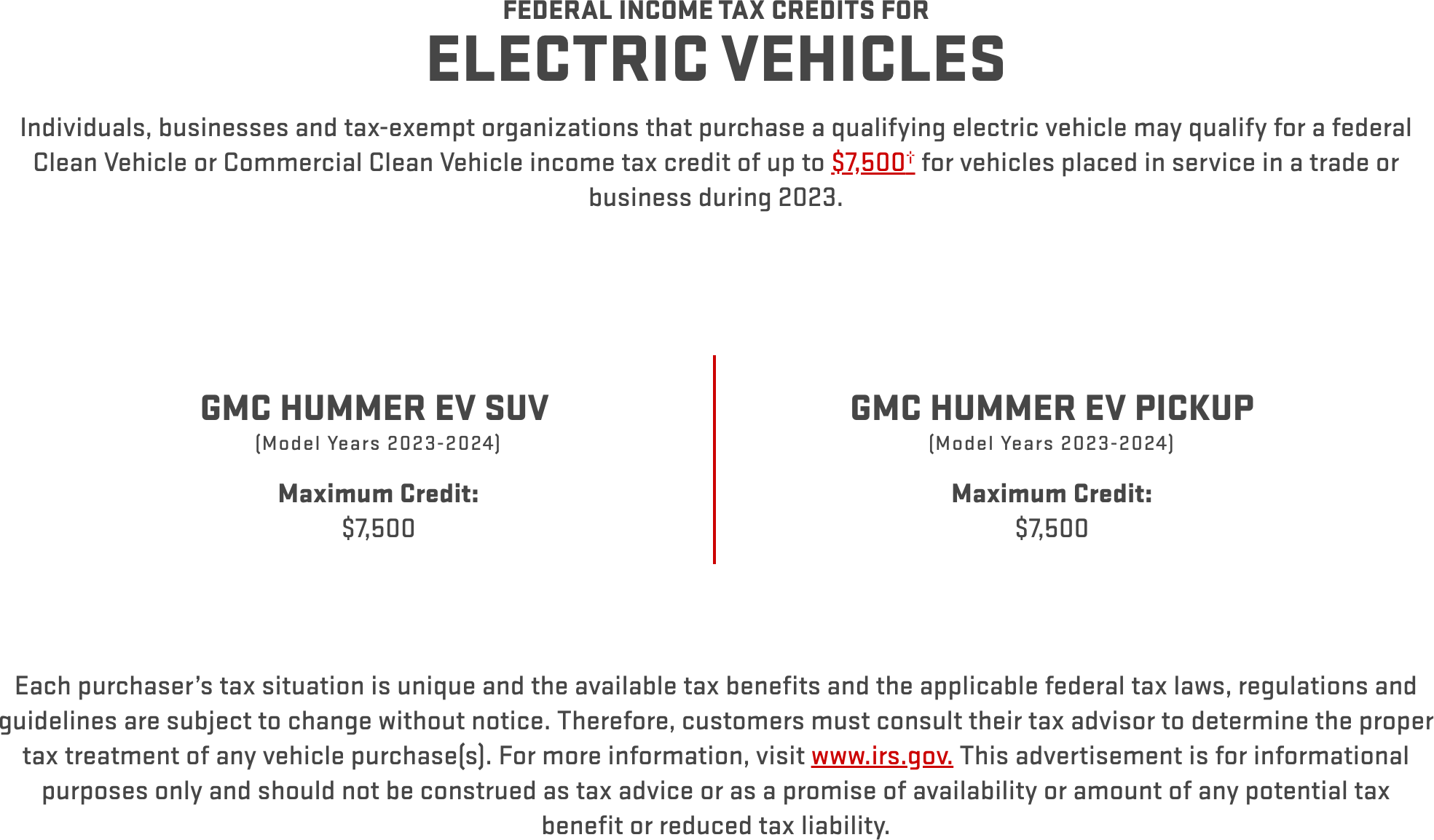

Source : www.chegg.comUnderstanding The Section 179 Deduction Coffman GMC

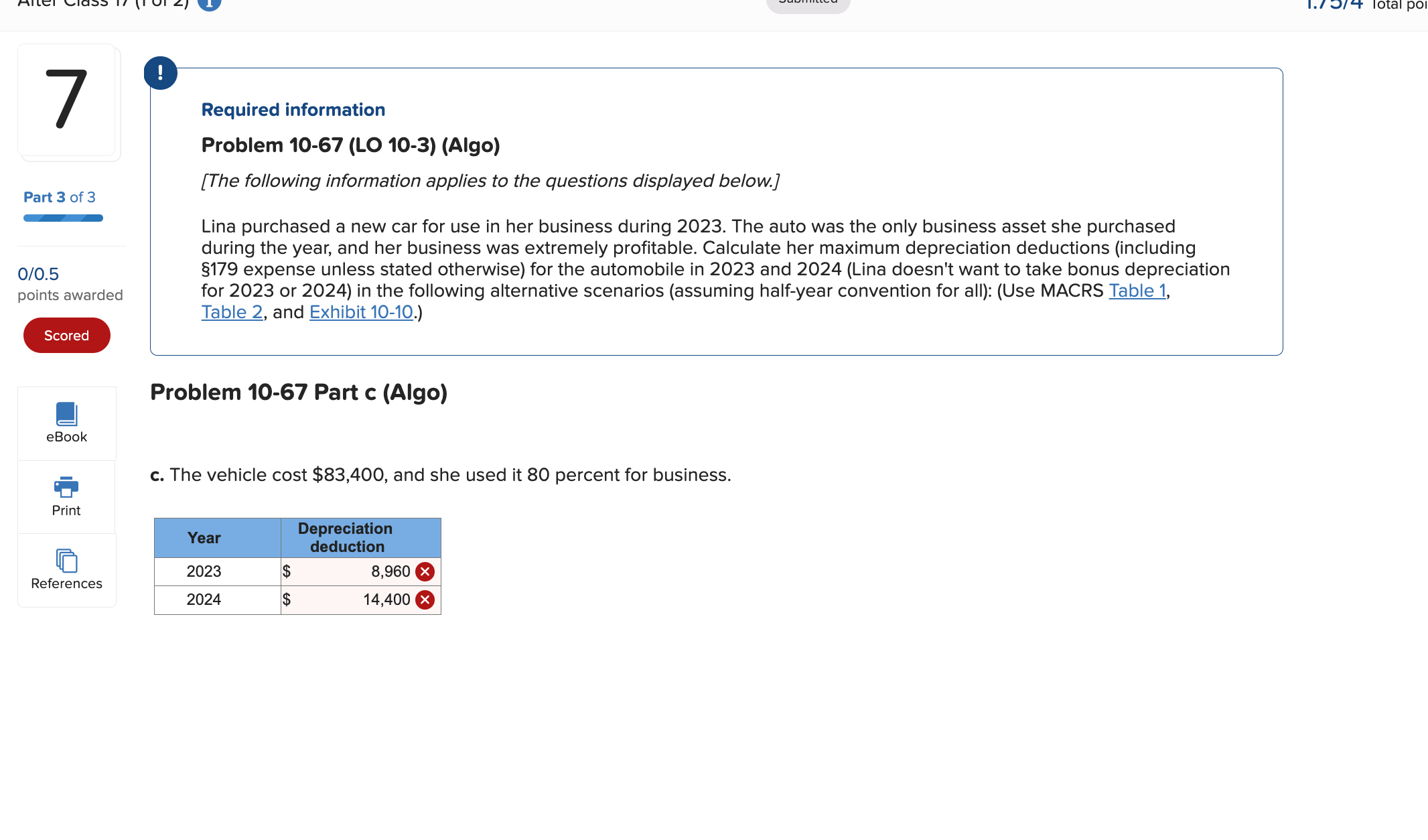

Source : www.coffmangmc.comSolved Lina purchased a new car for use in her business | Chegg.com

Source : www.chegg.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgSolved Tamika Meer purchased a new car for use in her | Chegg.com

Source : www.chegg.comCar Depreciation Limit 2024 For Business Use Tax Benefits For Your Small Business With Jeep® Vehicles: provided they use that megacar for “business purposes” at least 51 percent of the time and don’t exceed a deduction limit of $28,900. Add on “bonus depreciation” for business owners . U.S. News offers advice on the best classic car insurance for collectible and rare cars, restoration projects, and daily drivers. .

]]>